The ‘First Principles’ Technology Suite, eMACH.ai

The world's largest, most comprehensive and innovative Open Finance Platform

All products from iDTC have been built with eMACH.ai design principles, thus helping enterprises with agility, flexibility and composability, keeping the customer at the centre.

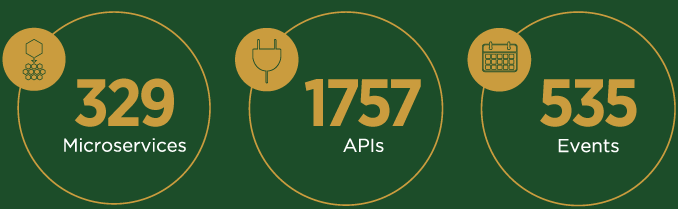

Powered with 329 Microservices, 1757 APIs

and 535 Events, eMACH.ai is the world’s largest and most comprehensive solution powered by the ‘First Principles’ Technology Suite for Technology-suave bankers to design future-ready technology solutions.

This suite

of First Principles Technology keeps a bank’s customer in focus, leveraging the smartness of the Cloud to design the banker’s own composable business impact solutions based on Event-driven architecture, ready-to-use deeply

rich functional Microservices and scores of APIs on Cloud Headless.

Contextuality

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Manage Money

Maximize the power of your money by leveraging our advanced solutions for Cash & Liquidity Management including, but not limited to:

- Accurate Balance & Transaction Reporting to know exact cash positions held by accounts at multiple Financial Institutions

- Rules Based Automated Sweeps supported in multiple flavours: Domestic, Multi-bank, Multi-currency, Cross border

- Intercompany Loans for tracking money movement within the organization as internal loans

- Virtual Accounts Management for maintaining complex corporate hierarchies and managing transactions on self-serve basis

Move Money

Utilize Intellect's contextual and intuitive digital solutions to:

- Initiate file based transactions such as salary processing etc. using EFT

- Initiate Interac Instant Payments for Businesses

- Initiate Cross-Border Funds Transfers including forex using SWIFT

- Track different types of payments at different life-cycle stages of of a payment

Digital Engagement

Digital Engagement Platform (DEP) offers a comprehensive range of creative solutions tailored to meet customer needs around Retail, SME & Corporate banking.

- Enhanced User Experience: DEP helps to craft personalized and intuitive digital experiences for customers of the Financial Institution. The platform prioritizes a user-centric design, delivering a modern and engaging interface that keeps users connected and satisfied.

- Open API: Digital Engagement Platform embraces openness, allowing seamless integration with third-party services, fostering a dynamic ecosystem and enabling endless possibilities for customization.

- Innovation with confidence: Our platform provides a robust foundation for innovation, helping financial institutions stay competitive in a rapidly evolving market with various DIY tools.

- Security First: We understand the paramount importance of security in the financial sector. The platform employs state-of-the-art security measures to safeguard transactions, data, and user privacy, ensuring peace of mind for both institutions and their customers.